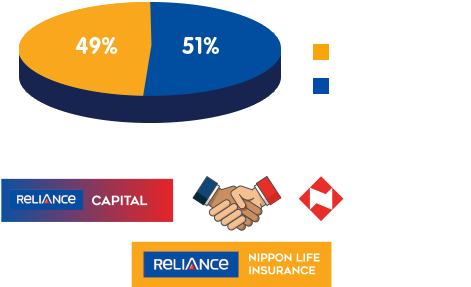

Reliance Nippon Life Insurance Company Limited is amongst the leading private sector life insurance companies in India in terms of individual WRP (Weighted Received Premium) and new business WRP. The company is one of the largest non-banks-supported private life insurers with over 10 million policyholders*, a strong distribution network of 713 offices and 61,036 advisors as on March 31, 2024. The company holds a Claim Settlement Ratio of 98.74% as on March 31, 2024. In FY23, Brand Finance recognized the company as India's 5th Most Valuable Insurance Brand.

Rated amongst the Top 25 companies to work for by Great Place to Work 2023, the company’s vision is "To be a company people are proud of, trust in and grow with; providing financial independence to every life we touch." Reliance Nippon Life caters to five distinct segments, namely Protection, Child, Retirement, Saving & Investment, and Health: for individuals as well as Groups/Corporate entities.

*Since inception of which many policies may have matured, lapsed, terminated and surrendered

Nippon Life, a Fortune Global 500 company, operates life insurance and asset management businesses globally and is the largest private asset owner in Japan.

Nippon Life will continue cultivating the domestic market, which is expected to show ongoing stable growth while developing its overseas strategy to secure growth opportunities.

In the asset management business which has a strong affinity with the life insurance business, Nippon Life is making efforts both in Japan and overseas to increase its investment income.

Extensive network of offices

(As on 31st Mar'2024)Total premium

(As on 31st Mar'2024)

A large team of highly motivated Advisors

(As on 31st Mar'2024)

Total Sum Assured

(As on 31st Mar'2024)

Assets under

management

13th month persistency

(As on 31st Mar'2024)

Note: Persistency declared is for regular pay policies as prescribed by IRDAI.Claim Settlement Ratio

(Individual death claim ratio

as per audited figures for FY24)

Download IRDA License / Certificate copy